Conventional Mortgage Loans

Get a quick quote on a our conventional loan products.

Conventional Mortgage Loans

Why a Conventional Loan?

Conventional loans are not insured or guaranteed by a government agency such as the FHA or the VA. Instead, conventional loans are typically originated and serviced by private lenders, such as banks, credit unions, or mortgage companies.

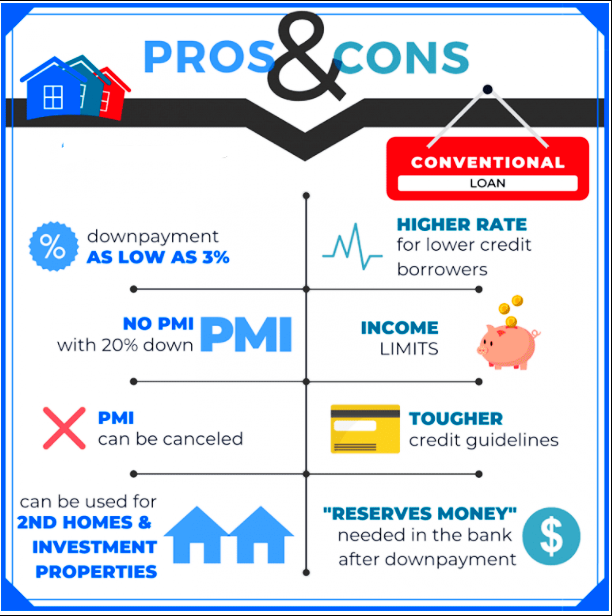

Conventional loans generally require a higher credit score and a larger down payment than government-backed loans. Typically, borrowers are required to have a credit score of at least 620, and a down payment of at least 3% to 20% of the purchase price,

Conventional loans offer more flexibility in terms of loan amounts, repayment terms, and interest rates, compared to government-backed loans. However, because conventional loans are not insured or guaranteed by the government, lenders are taking on more risk, so they may require higher interest rates or stricter loan requirements.

Misconceptions

- Difficult To Qualify – Conventional loans are accessible to a wide variety of home buyers. Borrowers with credit scores as low as 620 may qualify for a conventional loan, and down payment requirements can be as low as 3%.

- More Expensive – While conventional loans may have higher interest rates than government-backed loans, they often have lower upfront costs, such as mortgage insurance premiums. Additionally, borrowers with good credit and a solid financial history may qualify for lower interest rates on conventional loans.

- Need Great Credit – While a high credit score can help you qualify for a conventional loan and get better interest rates, it is not the only factor that lenders consider. Conventional loans have a credit score limit as low as 620.